Dynamic Economics: Shattering the Neoclassical Illusion with Real-World Firepower

eaarthnet’s answer to the ghouls of Davos & their voodoo economics! 26/Jan/26

Listen up, folks—economics isn’t a gentleman’s game of equilibrium puzzles; it’s a wild beast of booms, busts, and debt-fueled chaos. For too long, the neoclassical crowd has peddled their voodoo: static models where markets always clear, agents are rational robots, and instability is just a glitch in the matrix. Bollocks. As Steve Keen has hammered home for decades, that’s not economics—it’s fairy-tale physics applied to human folly. We’re calling it out: time to rally under Dynamic Economics, the banner for thinking that treats economies as evolving, unstable systems, not balanced spreadsheets.

Keen’s the trailblazer here, building on giants like Hyman Minsky, whose Financial Instability Hypothesis nailed it: stability breeds instability. Private debt doesn’t just accumulate; it explodes when banks chase profits without brakes. Remember 2008? That wasn’t a “black swan”—it was Minsky’s moment, where over-leveraged euphoria flips to panic. Keen took Minsky’s insight and ran with it, modelling how credit creation drives cycles far beyond the neoclassical blind spot.

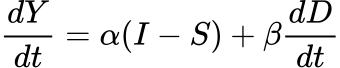

Let’s get mathematical, because hand-waving won’t cut it. In Keen’s Minsky-inspired models (drawing from Richard Goodwin’s predator-prey dynamics and Joseph Schumpeter’s creative destruction), economies aren’t linear—they’re nonlinear differential equations. Take a simplified Keen-Minsky setup for aggregate demand (Y) driven by private debt

Where I is investment (tied to profit rates), S is savings, and β captures debt’s multiplier effect. But here’s the kicker: investment isn’t stable; it’s a function of expected profits, which tank when debt ratios spike. Plug in Minsky’s twist—lending shifts from hedge (safe) to speculative to Ponzi (doomed)—and you get oscillations that neoclassicals ignore because their DSGE models assume away endogenous money.

Keen’s not alone; he’s amplified by progressives like Mariana Mazzucato, who skewers the “value extraction” myth and pushes mission-oriented innovation, or Yanis Varoufakis, exposing austerity as class warfare. These voices update Minsky for the polycrisis: climate breakdown, inequality, and digital feudalism. Dynamic Economics integrates it all—complexity theory, ecological limits, and debt jubilee ideas—to forecast and fix what static voodoo can’t.

Why now? Because the fiat house of cards is crumbling—derivative squeezes in gold/silver, BRICS ditching dollars, and AI extractivism echoing old colonial grabs. Dynamic Economics isn’t theory; it’s resistance. Join the fray at Eaarthnet, where we’re building unitive tools for sovereign futures, free from empire’s enclosures.